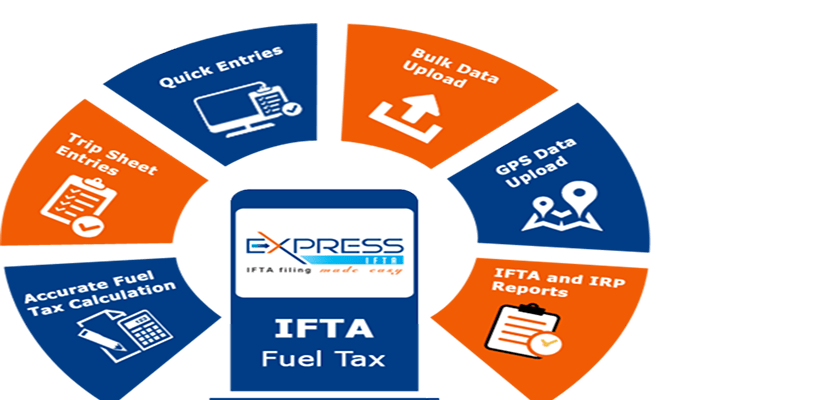

QuickHaul Solutions simplifies IFTA reporting, ensuring accurate fuel tax calculations and compliance with regulations. Our service helps trucking businesses track mileage and fuel purchases across jurisdictions, eliminating paperwork stress and potential penalties. Stay compliant and focus on the road while we handle the reporting process for you.

Filing IFTA reports can be complex and time-consuming, requiring precise records of fuel purchases and miles driven in each state or province. Our IFTA reporting service eliminates the guesswork, ensuring your reports are accurate, timely, and fully compliant with state and federal regulations.

We collect, organize, and verify all necessary data, helping you avoid costly penalties due to miscalculations or missed deadlines. With our streamlined process, you no longer have to deal with piles of paperwork or confusing tax calculations—we take care of it all.

Our service is designed to save you time and effort, allowing you to focus on running your business. Whether you operate a single truck or manage a fleet, our experts ensure your IFTA filings are accurate and submitted on time, keeping your trucking business in full compliance.

We understand the complexities of IFTA reporting. Here are some common questions:

We do not recommend the general internal use of essential oils. Essential oils internally without the necessary expertise required in administering them.

We do not recommend the general internal use of essential oils. Essential oils internally without the necessary expertise required in administering them.

We do not recommend the general internal use of essential oils. Essential oils internally without the necessary expertise required in administering them.

We do not recommend the general internal use of essential oils. Essential oils internally without the necessary expertise required in administering them.

We do not recommend the general internal use of essential oils. Essential oils internally without the necessary expertise required in administering them.